Flat tax

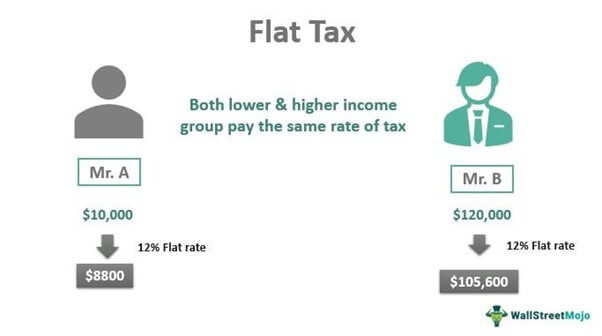

A flat tax to its critics is much more likely to hurt the poor and benefit the rich by taking more of a bite out of low-income folks budgets. For example a tax rate of 10 would mean that an individual.

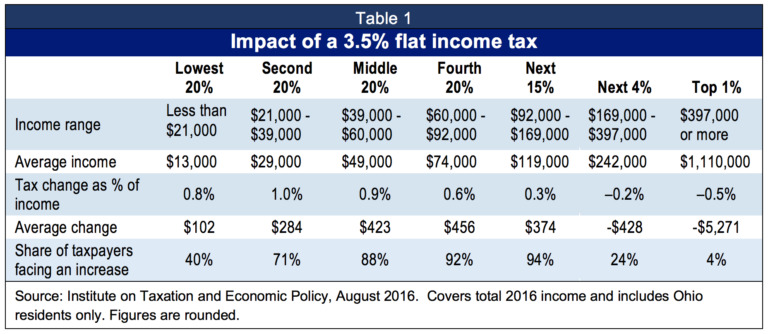

Flat Tax Would Mean More Taxes For Most

California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in.

. The idea is simple. For example a family of four. A state excise tax.

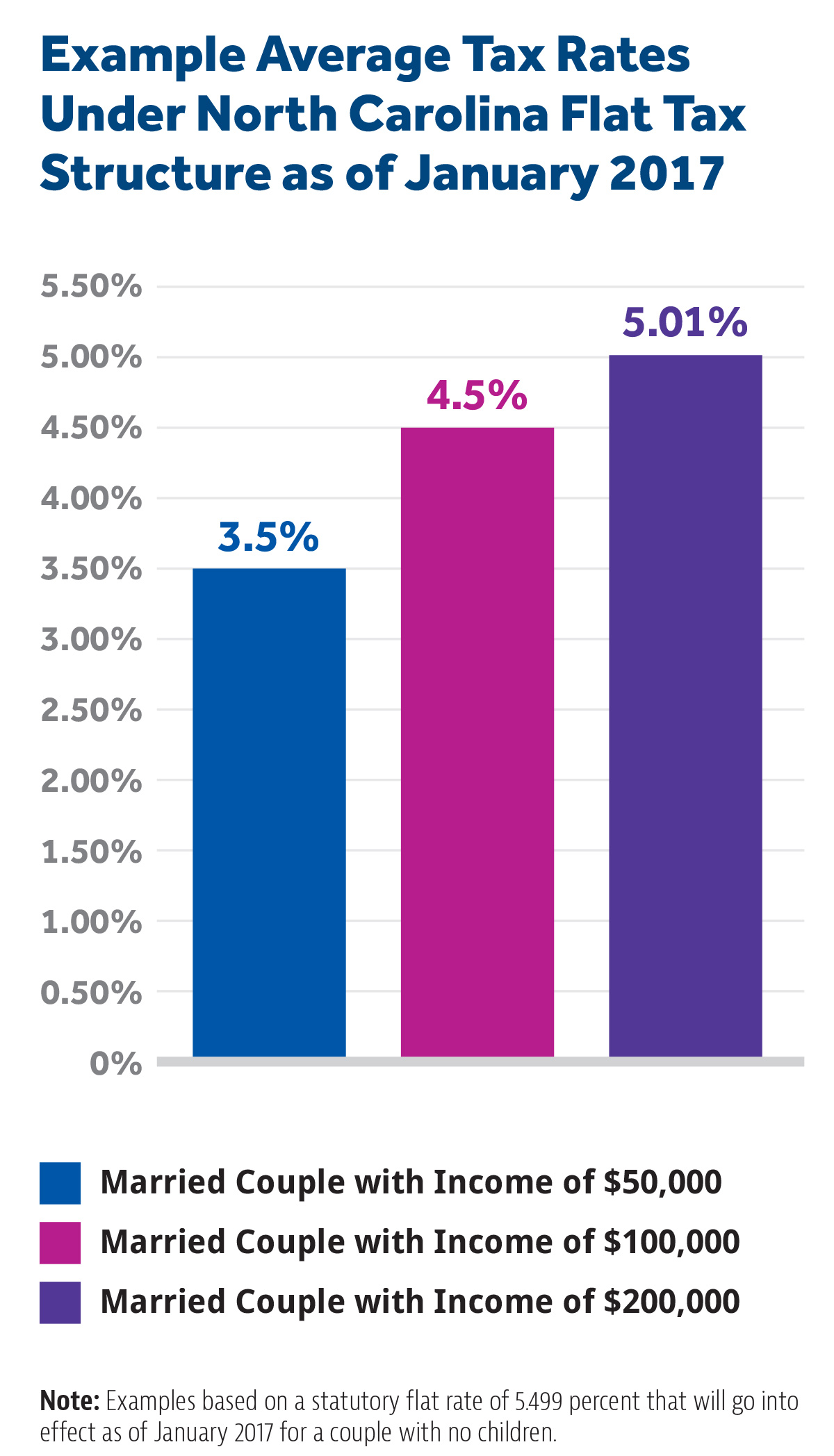

The amendment would also authorize the 1 million threshold to be. Flat tax systems are ones that require all taxpayers to pay the same tax rate regardless of their income. For instance Russia has a flat tax rate of 13 and.

However many flat tax regimes have. What Is a Flat Tax. A state sales tax.

If adopted by voters the change would take effect in 2023 and mark an historic departure from the states flat income tax rate structureCitizens for Limited Taxation on. Overall state tax rates range from 0 to more than 13 as of 2021. A flat tax is used when the same tax rate is applied to every taxpayer irrespective of income level.

Therefore except for the exemptions the economic. We would junk our horrid code and replace it with a single tax rate along with generous exemptions for adults and children. In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses.

A pure flat tax applies the same tax rate to all types of income. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. The tax would be levied in addition to the states 5 flat income tax for a total tax rate of 9 on income above 1 million.

An income tax is referred to as a flat tax when all taxable income is subject to the same tax rate regardless of income level or assets. Flat tax rates vary from country to country as well as year on year depending upon the income level and government in power. Bien que son nom paraisse anglophone la Flat Tax est un impôt français mis en place en 2018 sous le gouvernement Macron.

La Flat Tax aussi appelée Prélèvement. A local option for cities or towns.

Open Letter We Are Against The Flat Tax Proposal

Flat Tax Definition Examples Features Pros Cons

The Flat Tax Falls Flat For Good Reasons The Washington Post

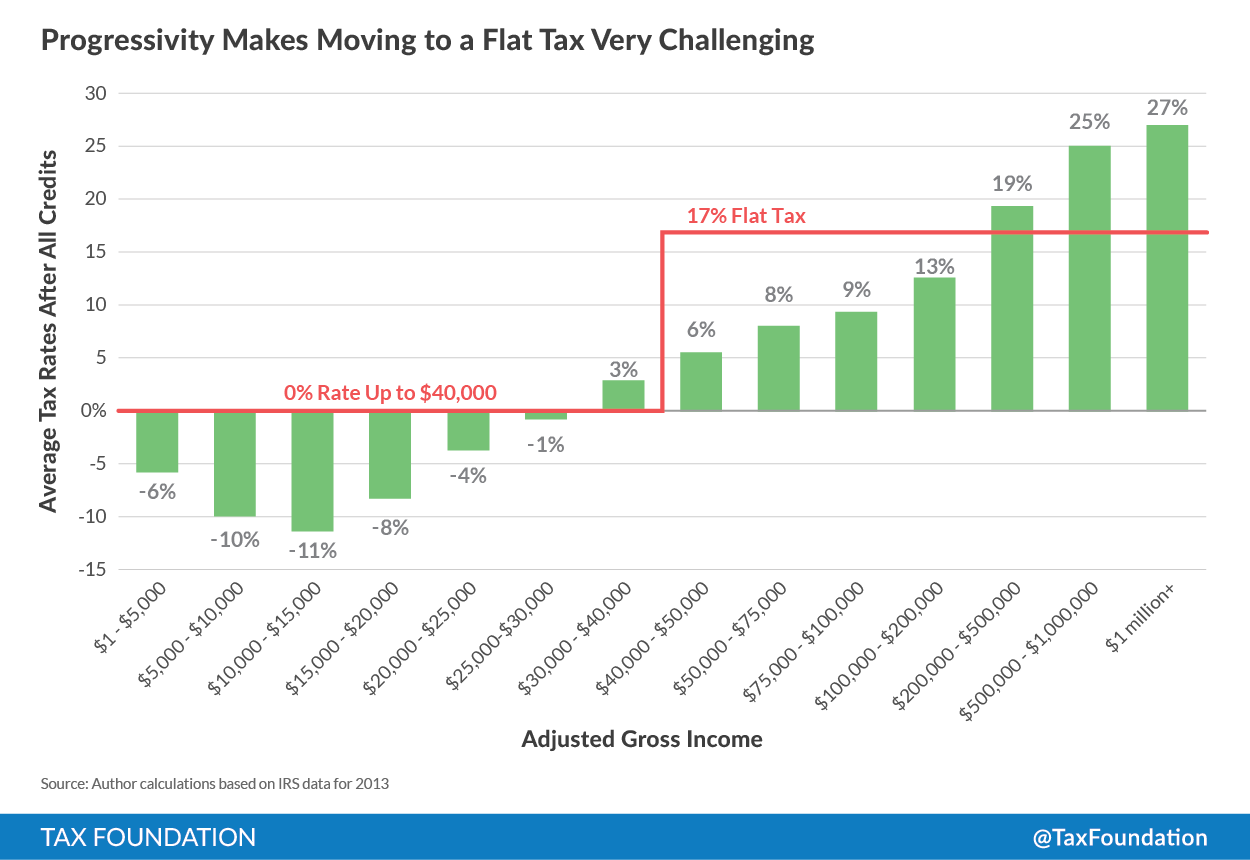

Biggest Challenge To Tax Reformers Overcoming Our Progressive Tax Code Tax Foundation

Is The Flat Tax The Biggest Problem Of Bulgaria S Economy 4liberty Eu

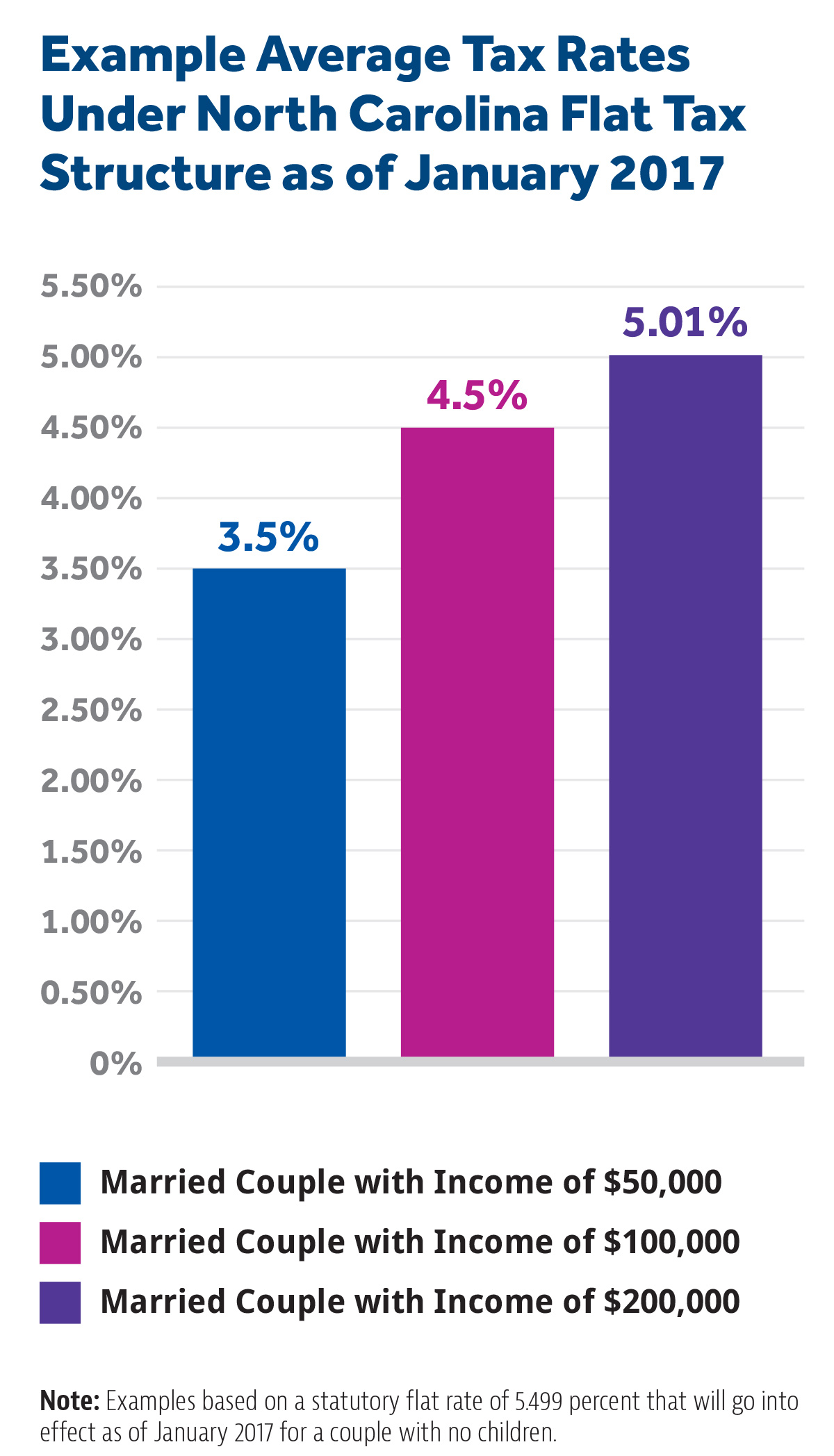

Assessing The Perry Flat Tax Tax Foundation

Flat Tax States Ff 11 02 2020 Tax Policy Center

Progressivity And The Flat Tax

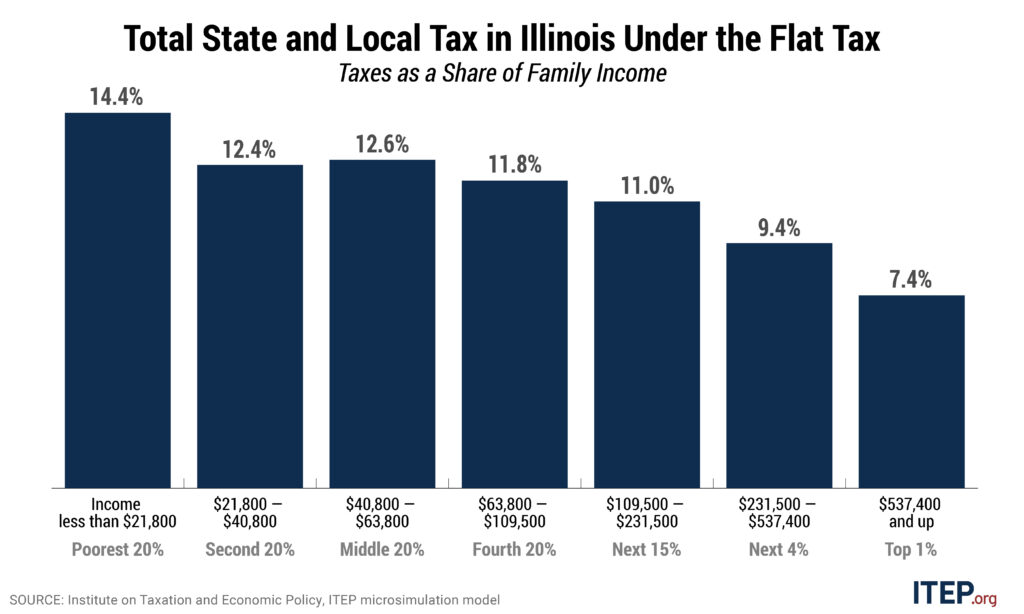

Illinois S Flat Tax Exacerbates Income Inequality And Racial Wealth Gaps Itep